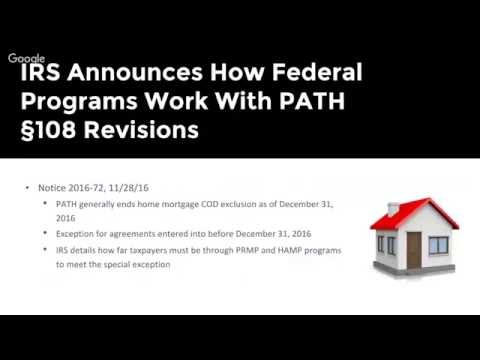

This is the Nichols Patrick current federal tax developments for the week of December 5, 2016. Current feral tax developments are brought to you by Nichols Patrick CP and your state society of CPAs. This week, we're going to look at defining due diligence among other things as we take a look at the developments for this week in federal taxes. Some of the key issues going to look at this year will include the Department of Justice has moved forward on their chasing down the Bitcoin users with the serving of a summons on Coinbase. A number of professional services announced are going to need to reconfirm their identities to continue to use e-services to obtain transcripts. The IRS raised the cost of installment agreements, which will be effective on January 1, 2017. Garrett's also issued a notice explaining to individuals who are participating in the PRM P and the HNP mortgage relief programs about how far through the process they're going to have to be by the end of 2016 to qualify under the special rule in the PATH Act that would allow them to continue to get relief from cancellation of debt even though their debt is not formally cancelled until 2017. Finally, and probably most significantly, the IRS issued temporary and proposed regulations that are going to deal with the expanded prepare due diligence rules coming up effective for the returns we will be preparing for 2016. Now we're getting back into late in the year again and we're here at the point where you need to get ready for tax season, so we have a few tax updates coming up here in the next couple of weeks. I thought I'd point out to you, depending on where you are in the country, we have an update...

Award-winning PDF software

2024 8867 due diligence note Form: What You Should Know

Determine your own tax liability based on the facts. 13861: Facts About Preparing Tax Returns for Individuals and Businesses for Tax Purposes According to Publication 4687, there are 4 requirements for Due Diligence: Prepare the return on your own for tax purposes. Determine your own tax liability based on the facts. 4014: Preparer's Due Diligence Instructions for Form 8867 for Tax Years Beginning and Ending in 2021 A complete review of the required contents of Form 8867 for taxpayers who meet the tax due diligence rules. 4014: Preparer's Due Diligence Instructions for Form 8867 for Tax Years Beginning and Ending in 2021 Paid preparer must complete and submit Form 8867 within 2 years. It has 2 components: The checklist and due diligence instructions. Taxpayers must include a completed Form 8867 with the return. Taxpayers must check the following items on Form 8867: Taxpayer Identification Number (Form SS-8). Compute the credits based on the facts. Date(s) of acquisition and use of the property. Compute the loss from disposal. Date(s) of sale of the property. Date(s) your employer terminated employment for your personal use. Compute the credit for income paid during the year. Compute the credit for capital loss from disposal of depreciable property. Date(s) when you acquired the property. Date(s) of sale of the property. Note: The items should be checked to obtain the most current and accurate information. For example, if you bought a property in a later year you do not always need to complete the form based on when you acquired the property. 4014: Preparer's Due Diligence Instructions for Form 8867 for Tax Years Beginning and Ending in 2021 Paid preparer must submit Form 8867 within 2 years of the date the return was prepared or, if earlier, within 40 days after the return was required to be filed. 13861: Qualified Plans, Agreements, and Trusts; Qualifying Small Businesses According to Publication 4687 there are 4 requirements for Due Diligence: Prepare the return on your own for tax purposes. Determine your own tax liability based on the facts.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8867, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8867 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8867 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8867 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 Form 8867 due diligence note