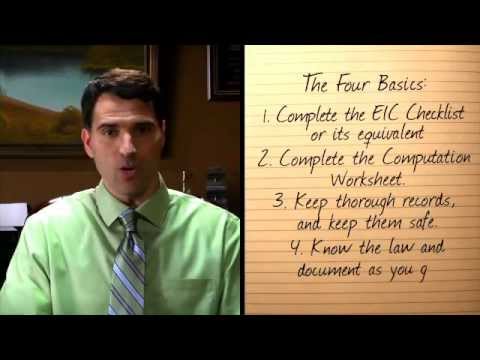

I read something the other day that got me thinking tax professionals do two-thirds of all a ITC claims with about 25% are filed an error for one reason or another could be a simple mistake like not understanding the law or taking what a client says at face value other times its outright fraud so it's pretty clear we paid preparers have to give due diligence more diligence having fewer errors protects the clients builds their trust gets us more referrals so it's good for business and it keeps us out of trouble who needs IRS penalties that with a little extra diligence could have been avoided and besides it's the right thing to do I mean the EITC is supposed to go to working people who qualify not cheats and scam artists right so let's get back to basics for just a minute the for due diligence requirements every paid preparer must do one complete the EIC checklist or its equivalent working through the checklist forces us to consider all the eligibility criteria to complete the computation worksheet it shows all the income sources we factor like self-employment income wages interest income and adjusted gross three keep thorough records either paper or electronic for three years that includes copies of schedule EIC the computation worksheet and a record of how when and from whom you got the information to prepare the return keep them where they can be readily accessed if an IRS representative asks to see them but also keep them safe you don't want confidential information in the wrong hands for know the law and use your knowledge to ask each client the right questions and get all the relevant facts make sure you document as you go the whole process is so much easier now...

Award-winning PDF software

Eitc due diligence sample questions Form: What You Should Know

Sep 18, 2025 — Have you filed tax returns for each of the last 6 years? Sep 26, 2025 — Have you always paid the full amount due? · Have you paid the maximum amount per calendar year that the IRS or the State requires? Sep 27, 2025 — Have you ever failed to pay tax to the IRS on a payment made to a taxpayer, or the State? If so, ask for payment records. · Have you ever filed an amended return to correct any errors found on your original return? · Have you ever received any IRS letters or notices, and has anyone else contacted the IRS? If there is any. Sep 28, 2025 — What is the estimated due date of the tax liability? · For each child, tell what your date would be if the child had not been born on a regular pay date. Sep 29, 2025 — When did you separate from your husband, and when did you become legally separated from the former husband? Sep 30, 2025 — Is there documentation that shows where or when you lived that was different from the information on your tax return? Sep 30, 2025 — If the child is 18 or younger when the child comes of age, and if the parent dies, tell if you will use their name. Sep 30, 2025 — If the child is 17 or older when the child comes of age, but was 19 on the original return, tell the child if you will use their name. Sep 30, 2025 — Tell your clients the name and date that the child would be coming of age. Sep 30, 2025 — Tell the clients if they have any family members that will claim the child as a dependent, and if so, tell them the type of dependent and the number of dependent children that the child will claim. Sep 30, 2025 — If there is any other family member that they claim the child as a dependent that would apply to the child's credit under any of the following situations, and if they do: Keep copies of all tax forms; if you are asked to fill out a tax form in lieu of the child's return, have them sign each of the tax forms if you need to.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8867, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8867 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8867 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8867 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Eitc due diligence sample questions