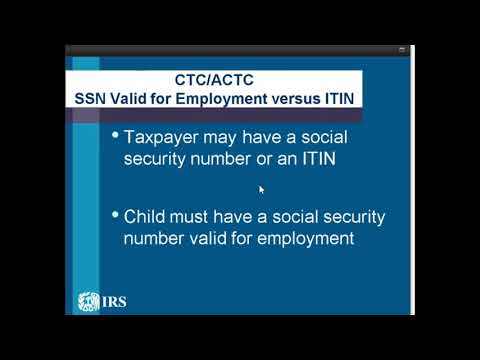

Can you introduce us for these changes? I sure will. Alright, so under the new law, in order to qualify for both the non-refundable Child Tax Credit (CTC) and the refundable Additional Child Tax Credit (ACTC), the qualifying child now must have a valid social security number issued before the due date of the tax return, and that includes extensions. This is a big change. The CTC is worth up to $2,000 per qualifying child, and the age requirement remains the same - the child must be under 17 at the end of the year in order to claim the credit. Now, the refundable portion of the credit has also gone up - it is now $1,400 per qualified child. That amount will also be adjusted for inflation after tax year 2018. The Earned Income minimum in order to qualify for the refundable ACTC with only one or two children was $3,000 in past years, but now it has been lowered to $2,500. Also, in past years, a taxpayer claiming the CTC must have been able to claim an exemption for each child on their tax return. Now, even though the dependency exemption is now zero until after tax year 2025, the taxpayer must still meet the dependency rules in order to claim a qualifying child for CTC. So, you still need to do your research and due diligence. As in the past, the taxpayer must be a US citizen or US resident. Therefore, any children that might be residing in Mexico or Canada who weren't US citizens will not qualify for this credit. There is also another significant change I wanted to share with you that is affecting your clients with higher income. So, we're going to take a look at a chart to help you understand why. First, let's...

Award-winning PDF software

Due diligence for other dependent credit Form: What You Should Know

Form 40 — North Dakota Corporation Tax Return. Form 40-UT — Underpayment of Estimated North Dakota Income Tax by Corporations. Form 690 — Individual Income Tax Returns. 2025 and prior years. For an individual income tax return, please contact Your County Assessor Your County Assessor Office Form 88A — Business Owners' Income Tax Return. Form 90 — State Tax Withheld from Workers' Compensation. In 2018, this form is to be used at tax time by all self-employed persons. Form 90-2: Supplemental State Tax Withheld from Workers' Compensation. Form 110-S: State Income Tax Return. If you file for a business owner to claim an exemption on their state income tax, they must file a Schedule B, Business Income Tax Return with this form, if they have made more than 500,000 in profit from active trade in 2017. Form 110S is for taxpayers who make less than 500,000 in profit in 2017. This form should be completed and sent to the proper place. Form 110S replaces a form which was formerly listed below. Form 110-H: Self Employed Business Income Tax Return. If a business owner does not claim an exemption based on having more than 50,000 of business income for the last two calendar years, the taxpayer must file Form 110-H, Self Employed Business Income Tax Return. Form 110-H, Self Employed Business Income Tax Return, is used for taxpayers with less than 50,000 of business income, including: sole proprietorship, as a partner, or as a sole owner with stock owned less than a controlling interest. Form 1097-B: IRS Income Tax Return. If you file for an income tax return for 2025 and receive an IRS Form 1097-B, your return is timely filed under the regular rules for filing income tax returns, even if you did not have to file a Form 1097-C, Application for Certificate of Exemption From Form 4868. This form can be used to file an exemption on your federal income tax return based on your adjusted gross income (AGI) without completing a Form 4868. This form must be filed by the deadline for filing income tax returns, including extensions. Form 1040 — North Dakota Individual Income Tax Return. North Dakota taxpayers filing their individual income tax returns in person must utilize a Schedule.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8867, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8867 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8867 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8867 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Due diligence for other dependent credit